Perry, Dewhurst, Craddick: Boost highway funding now

Sweeping policy changes to jump-start renewed construction of roads proposed.

Letter to Texas Transportation Commission Chairwoman Deirdre DelisiAugust 22, 2008

By Mike Ward, Robert Elder

Austin American-Statesman

Copyright 2008

With highway construction slowing because of red tape and budget woes, Texas' top three leaders —

Gov. Rick Perry, Lt. Gov. David Dewhurst and House Speaker Tom Craddick — on Thursday proposed sweeping policy changes to jump-start and pay for new road projects.

In a letter to Texas Transportation Commission Chairwoman Deirdre Delisi, the three proposed significant changes in how Texas pays for the roads it builds and said they have

"agreed to work together" to make changes.

Otherwise, they said, the state's "ability to fund needed transportation projects in the future is limited," due to cutbacks in federal highway funding, limitations of existing state funding programs and population growth that continues to outpace infrastructure planning.

One prong of the plan would create a Transportation Finance Corporation to allow state investment funds — including the state employee and teacher retirement systems, among others — to directly invest in state transportation projects. Combined, the two state systems manage $135 billion in assets.State pension officials took a cautious view of investing in state projects in testimony this year before the Senate Finance Committee, saying a mandate to invest in Texas infrastructure could conflict with their duty to find the best return on investment for retirees.Other highlights of the leadership's plan:

- Eventually stop funding the Texas Department of Public Safety with gas tax funds, and divert that money — as much as $600 million a year — to road construction. DPS could instead be funded with general revenue tax funds, the proposal suggests.

- Quickly authorize as much as $5 billion in bonds for additional highway construction projects. Voters approved a constitutional change in November 2007 to allow these bonds, but legislation is still needed to authorize them.

- Within the next month, sell up to $1.4 billion in bonds already authorized for construction "to ensure that greater road funding levels are maintained through the fall and spring" until the other changes can be made.

Aides to Perry and Craddick said the letter reflects an agreement between Perry and legislative leaders that has been the subject of ongoing negotiations.In a statement,

Dewhurst seemed to agree: "The Legislature is firmly committed to crafting a long-term solution to our state's transportation challenges, while the steps we are taking with this agreement and our current discussions with TxDOT will allow us to meet the priority new construction needs over the next three years."

Delisi didn't return a phone call seeking comment Thursday.

State Sen. Kirk Watson, D-Austin, an advocate for improving Texas' transportation policies, said he supports stopping the diversion of gas tax revenue to DPS and the proposed bond sales.

"The voters have said they want that," he said. "We should look to the local entities to make sure the money goes where people want it to go."

Watson called the financing corporation an idea worthy of further discussion.Thursday's move came five months after legislative leaders had proposed that the Texas Department of Transportation borrow an additional $1.5 billion against future gas tax revenue to bridge a financial tight spot that was slowing construction.

In February, the agency had announced it would stopped pursuing many new construction projects because funding would not be available in future years to pay for them. In addition, the agency chopped its Central Texas engineering budget from $45.2 million to $19.6 million, further stalling the dates that several proposed new road projects would be completed.

Highway contractors complained at the time that while the funding rollbacks would reduce available projects during the next two years, it could also adversely affect future projects by delaying design and planning work.

The invest-in-Texas-roads idea isn't new.

In May 2007, the transportation department's research division published a report titled, "Transportation Infrastructure Opportunities for State Government Pension Plans."The report said "infrastructure investment, particularly in transportation, has the potential to provide strong, steady returns, and

pension plan administrators should embrace this new asset class."At a March meeting of the Senate Finance Committee, Chairman Steve Ogden, R-Bryan, proposed that the teacher and state worker pension funds could loan money for infrastructure projects on their own accord or invest alongside private entities through a newly created partnership.

"Our trust funds are now investing in infrastructure in other states and other countries," Ogden said, so it may make sense for the funds to invest in Texas.

Ogden's Capitol office said he wasn't available for comment Thursday.

Pension fund officials told Ogden at the hearing that any investment must earn a competitive return with similar deals.

Britt Harris, the chief investment officer of the Teacher Retirement System of Texas, said infrastructure investing could make sense if the deal was

"equal to or better than something we can get in another (investment) vehicle."The pension fund's "ultimate loyalty is to the members," Harris said, not to target investments based on geography or politics.Mary Jane Wardlow, spokeswoman for the

Employees Retirement System of Texas, said system officials had only seen the letter Thursday and had no comment on the plan.

mward@statesman.com; 445-1712; relder@statesman.com; 445-3671

© 2008 Austin American-Statesman:

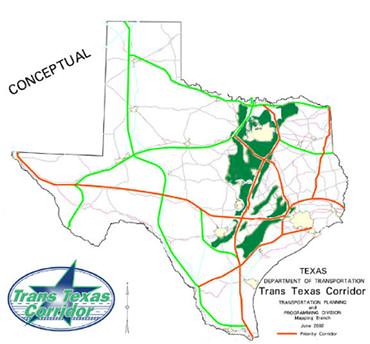

www.statesman.comTo search TTC News Archives click HERE

To view the Trans-Texas Corridor Blog click HERE

The September issue of National Geographic has an interesting article, “Our Good Earth,” on the soils of the world and the dangers to them.

The September issue of National Geographic has an interesting article, “Our Good Earth,” on the soils of the world and the dangers to them.