Leasing highways is gaining traction around nation 7/23/2006

By Elisa Crouch

St. Louis Post-Dispatch

Copyright 2006

Selling the Brooklyn Bridge is an old joke, but leasing the Chicago Skyway for $1.8 billion wasn't.

Nor was leasing the Indiana Toll Road for $3.8 billion or a future 40-mile stretch of Texas highway for $1.3 billion.

As Missouri officials try to persuade Illinois to lease a future $910 million Mississippi River bridge to private investors, other states and cities are moving forward with similar deals.

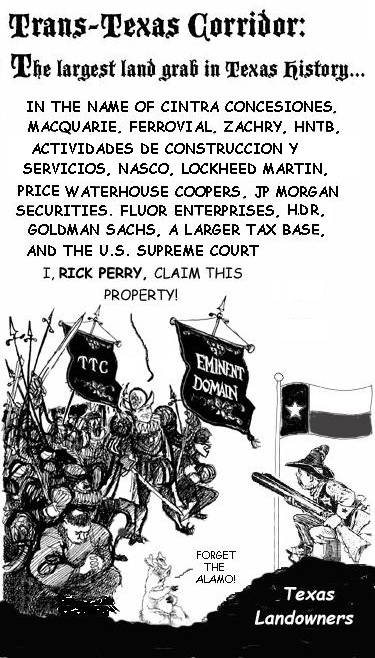

Called public-private partnerships, they give governments large infusions of cash in exchange for the operation and maintenance responsibilities of bridges and highways. Where no road or bridge exists, investors build it themselves and without many of the bureaucratic constraints that slow construction. Private entities can secure longer-term loans than governments, giving them more time to repay debt and turn a profit through tolling. And, they allow politicians to open new roads without asking voters for a tax increase.

Advertisement

The partnerships reverse the notion that highways are a public responsibility, a view held since the early 19th century, when governments took over roads, bridges and canals that had gone bankrupt in private hands.

Privatization is common practice in Europe and Australia. In the United States, it's not. States from New Jersey to Oregon and Alaska are considering privatization for a number of projects without much of a track record to learn from.

"There's a learning curve," said Neil Grey, director of government affairs for the International Bridge, Tunnel and Turnpike Association, an alliance of toll operators. "We don't have a lot of experience in it to tell you the truth."

Skeptics say agreements are quietly hatched and more motivated by money than interests of the motoring public. The leases can keep the public sector from fixing future congestion problems. Noncompete clauses can impose a decades-long prohibition on building nearby roads that motorists can use for free, or adding lanes to nearby highways.

Proponents argue that partnerships are a way to fix the nation's decaying interstate system. Revenue from federal and state gasoline taxes is falling further behind the need. Where the free interstate system was the model for the 20th century, some argue that public-private partnerships are the model for the 21st.

Missouri Transportation Director Pete Rahn is an advocate of building a new river bridge this way.

RELATED

Public-private highway projects

"Clearly, our resources as states do not allow us to tackle very many big projects," he said. "If the public is not willing to pay the taxes necessary to construct and maintain our interstate system, then we have to find alternatives."

The 2005 lease of the Chicago Skyway sent legislatures exploring privatization, primarily due to the $1.8 billion windfall the city received from the deal. The 7.8-mile elevated highway is now operated by Cintra Macquarie, a Spanish-Australian consortium. The consortium also paid Indiana $3.8 billion last month to lease the Indiana Toll Road.

A Fitch Ratings report in March says toll roads are good candidates for privatization. It also cites several North American flops.

A Toronto toll road operator defaulted on debt payments in 2004. The city and the concessionaire sparred over toll rate increases, resulting in numerous lawsuits.

In 2003, Orange County, Calif., bought out investors who built and operated the "91 Express Lanes" so the county could expand traffic capacity on nearby roads. A noncompete clause in the 1995 lease prohibited nearby road expansion. The toll lanes were a financial success, but privatization became a political problem when traffic increased.

"It's a mixed bag of success," said Matthew Sundeen, a transportation policy specialist at the National Conference of State Legislatures. "It depends who you talk to as far as how successful they are."

This month, Gov. Matt Blunt signed a bill that allows Missouri to enter into such an agreement to build a new Interstate 70 bridge between downtown St. Louis and Illinois. The arrangement would allow investors to build the project with private money, operate the bridge and charge tolls for up to 99 years to recover construction costs.

Motorists would pay those tolls, unless the states adopted "shadow tolling." This kind of tolling charges government for each vehicle using the bridge, rather than charging motorists.

Illinois Gov. Rod Blagojevich says he opposes any bridge financing method that results in tolling Illinois motorists. In northern Illinois, motorists use the 50-year-old Illinois Tollway, which is its own self-supporting entity and does not use state or federal money. No tolling facility exists in Southern Illinois.

Legislators are holding hearings on leasing the 274 miles of toll road, which runs through northeastern Illinois, an idea that Blagojevich and his Republican opponent, Illinois state Treasurer Judy Baar Topinka, have publicly opposed.

The Legislature approved a bill this year allowing public-private partnerships in Illinois, opening up the possibility for the Tollway. Sen. Frank Watson, R-Greenville, said privatizing a new Mississippi River bridge should be examined more closely. Without Illinois' approval, Missouri cannot solicit bids for a private partner, Rahn has said.

"It has to be acknowledged that it's an option," said Doug Whitley, president of the Illinois Chamber of Commerce. "Having said that, it makes it more complicated than a straight government project. You're breaking the mold. You're trying to do something new."

Missouri's legislation allows tolls only on the new bridge - the other river bridges would remain free. A public-private partnership for any other project would need separate legislative approval.

The legislation also says that details of a partnership agreement would be kept private until becoming final, giving the public no opportunity to evaluate details such as caps on toll rates, maintenance standards and timely removal of roadkill.

Rahn said he would handle the process more openly than the legislation calls for. Information would be kept private only until all bids are in, he said.

"There's a reason you want to protect information at that very early crucial stage. It's only fair," Rahn said. "But, once you've gone through a solicitation process, once you've accepted the proposals and you're not accepting any more, at that point the proposals have to be shared with the public - prior to making the choice."

More than 21 states have legislation allowing for public-private partnerships. Off-shore investors are doing much of the bidding. A handful of U.S. investment banks, including Goldman Sachs & Co. and JPMorgan Chase & Co., are reportedly trying to get in on the action.

"Basically, we're saying government's for sale," said Don Schaeffer, vice president of the Mid-West Truckers Association. "Just because it's a foreign entity doesn't mean it's bad, but it raises questions on who's controlling infrastructure in the United States."

ecrouch@post-dispatch.com 314-340-8119

© 2006 St Louis Post-Dispatch:

www.stltoday.com